All Categories

Featured

Table of Contents

assure a stream of revenue for the remainder of the annuitant's life, nevertheless long that might be, or for the life of the annuitant and their spouse if they buy a joint lifetime annuity. Missing a joint-and-survivor provision, nonetheless, the annuitant is the just one who can benefit. Assume of it as a personal contract made to benefit the annuitant alone.

The even more cash that was placed in, and the later the settlements were begun, the larger those settlements will be. Yet the agreement terminates at death. If the annuitant acquisitions a life time annuity, it suggests they can't outlive their revenue stream, however it also means the beneficiaries will not reach assert the advantage after the annuitant's gone., also called, pay out over a limited amount of time - Annuity withdrawal options.

Therefore, they may possibly outlast their advantages. On the flipside, though, if they die prior to the agreement expires, the cash can pass to a marked recipient. pay at an assured interest price but offer a fairly modest rate of return. If you acquire a fixed annuity, you'll understand what you're entering terms of growth.

This sets you back added yet provides the recipient the greater of these 2 payments: The agreement's market value. The total of all contributions, when costs and withdrawals are deducted. It is necessary to keep in mind that the size of the costs being returned will be less than it was at first, relying on just how much of it the original annuitant has absorbed repayments.

Taxes on inherited Annuity Income payouts

are optionalclauses in an annuity agreement that can be used to customize it to certain requirements. They come at an additional price due to the fact that they generally offer an additional degree of protection. The more motorcyclists purchased, the higher the rate is to pay: Each motorcyclist commonly costs in between 0.25% and 1% yearly.

Without such a cyclist, the remaining money would certainly revert to the insurance provider, to be merged with funds for various other life time annuity holders who might outlive the quantity they would certainly spent. It would not most likely to the beneficiaries. (This is a compromise for the insurance firm since some annuitants will outlive their investments, while others will certainly die early.

It costs added due to the fact that the insurer needs something to offset the cash it might otherwise utilize for its pool. Is this included price worth it? If the annuitant is in excellent health and believes they may consume all or most of the costs prior to they pass away, it may not be.

Under this motorcyclist, the insurance provider records the worth of the annuity each month (or year), then makes use of the greatest number to identify the benefit when the annuitant dies - Annuity income riders. An SDBR protects beneficiaries of variable annuities against market variations: If the worth occurs to be down at the time of fatality, the recipient still obtains the top-line quantity

But the safeties behind the lottery payment are backed by the united state government, which really makes them safer than any type of privately backed annuity. Choosing to take annuitized installation repayments for lotto winnings can have a pair of benefits: It can defend against the lure to spend beyond your means or overextend on responsibilities, which may cause monetary difficulties and even personal bankruptcy later on.

Inherited Annuity Cash Value tax liability

If you buy an annuity, you can set the regards to the annuity contract, decide what sort of annuity to buy, select whether you want cyclists, and make other decisions. If you inherit an annuity, you may not have the exact same options, particularly if you weren't a spouse with joint ownership.

Take a lump-sum payment. Take the complete payout over the following five years under the five-year regulation. Yes. An annuitant can name a primary recipient and a contingent recipient, yet likewise can call greater than one in either classification. There's actually no limitation to the variety of main or contingent recipients that can be called.

And (sorry, pet lovers), Fido or Floofer can not be called as a beneficiary. Neither can a pet rock or other non-living object. Yes. An acquired annuity can supply money for the recipient to pay off significant expenditures (such as pupil financial debt, a home loan, health-care expenses, etc). If you decide to offer your inherited annuity, you can do so in among 3 methods: You can market all your set up repayments for the remainder of the annuity contract term and obtain a lump-sum settlement in exchange.

If you have 15 years continuing to be on your acquired annuity, you can offer the very first five years and receive a swelling sum for that. After those five years are up, repayments will certainly resume. If you favor not to await repayments to launch once again, however you need some cash currently, you can offer a part of each settlement and obtain a lump sum.

Tax treatment of inherited Index-linked Annuities

Depending upon your credit score, the term of the loan and other elements, you might finish up paying practically as much in passion as you got via the loan. A 30-year home loan worth $200,000 would certainly cost you a total of even more than $343,000 when all is stated and done.

The solution to this inquiry depends upon a number of elements. Amongst one of the most crucial is when the annuity was acquired. If you purchased an annuity prior to your marital relationship, it may be considered your separate property and not qualified to be separated by the court. However, an annuity purchased during the marital relationship might be seen, legally, as neighborhood property and subject to department.

Dividing an annuity in a separation can have extreme tax effects. If you possess a certified annuity probably it was component of a pension plan, 401(k), or various other employer-sponsored retired life plan funded with pre-tax dollars you will certainly require a (QDRO).

This means that the recipient's share of the annuity earnings would certainly pass on to successors if the beneficiary passes away prior to the contract owner., was passed in 1974 to secure retirement financial savings and uses especially to retirement strategies sponsored by private staff members.

Fixed Annuities and beneficiary tax considerations

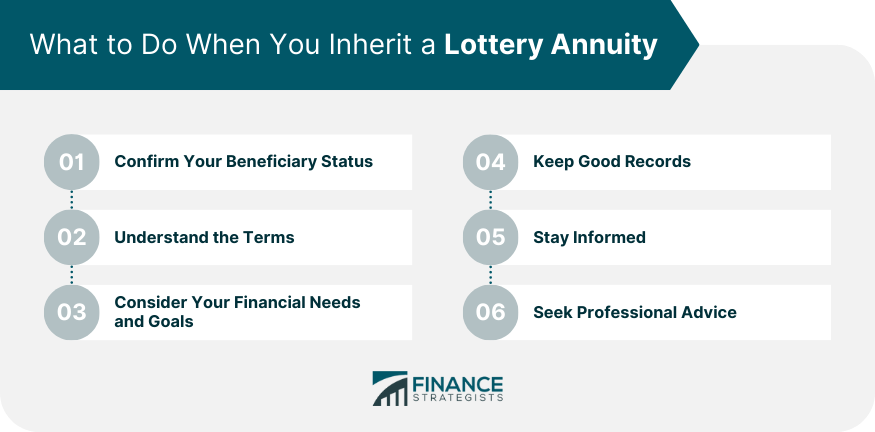

A non-designated beneficiary is an entity such as a charity, trust fund, or estate. Non-designated recipients undergo the five-year policy when it involves annuities. So, if you inherit an annuity, what should you do? The response depends upon a selection of elements linked to your monetary scenario and individual objectives.

There's absolutely tranquility of mind in owning your own home; you'll have to pay residential property taxes, however you will not have to worry regarding proprietors raising the rent or sticking their nose in your business. The tax obligation liability and charges you incur by cashing in your annuities all at when could be offset by the profits from that new business or the recognition worth on a home.

Table of Contents

Latest Posts

Highlighting the Key Features of Long-Term Investments Everything You Need to Know About Financial Strategies Defining Variable Annuities Vs Fixed Annuities Features of Smart Investment Choices Why Fi

Highlighting the Key Features of Long-Term Investments Key Insights on Variable Vs Fixed Annuity Defining Indexed Annuity Vs Fixed Annuity Benefits of Indexed Annuity Vs Fixed Annuity Why What Is A Va

Exploring the Basics of Retirement Options Everything You Need to Know About Deferred Annuity Vs Variable Annuity Defining the Right Financial Strategy Features of Smart Investment Choices Why Choosin

More

Latest Posts